Frequently Asked Questions

{beginAccordion}

What is a wire transfer & what is Fidelity Bank’s wire transfer routing number?

A: A wire transfer is an electronic transfer of funds from one financial institution to another. To receive a wire transfer into your checking account, you will need to provide the sender of the wire transfer with the appropriate routing number and your checking account number. Fidelity’s routing number for domestic wire transfers is 265070532.

For incoming international wire transfers, you will need to provide the following information on both the creditor/beneficiary bank and intermediary bank that are involved in sending the wire to your Fidelity account:

Intermediary/Receiving Bank:

| Swift Code: | FRNAUS44 |

| Routing/ABA #: | 065403370 |

| Intermediary Bank Address: | FNBB (First National Bankers Bank), 7813 Office Park Blvd., Baton Rouge, LA 70809 USA |

Reference Creditor/Beneficiary Bank:

| Bank Name: | Fidelity Bank |

| Bank Address: | 353 Carondelet St., New Orleans, LA 70130 USA |

| Bank Account #: | [Customer Fidelity Bank Account Number] |

| Instructions: |

[Customer Name] [Customer Address] |

Please refer to our Fee Schedule for a complete list of wire transfer fees.

Where can I find my checking account number?

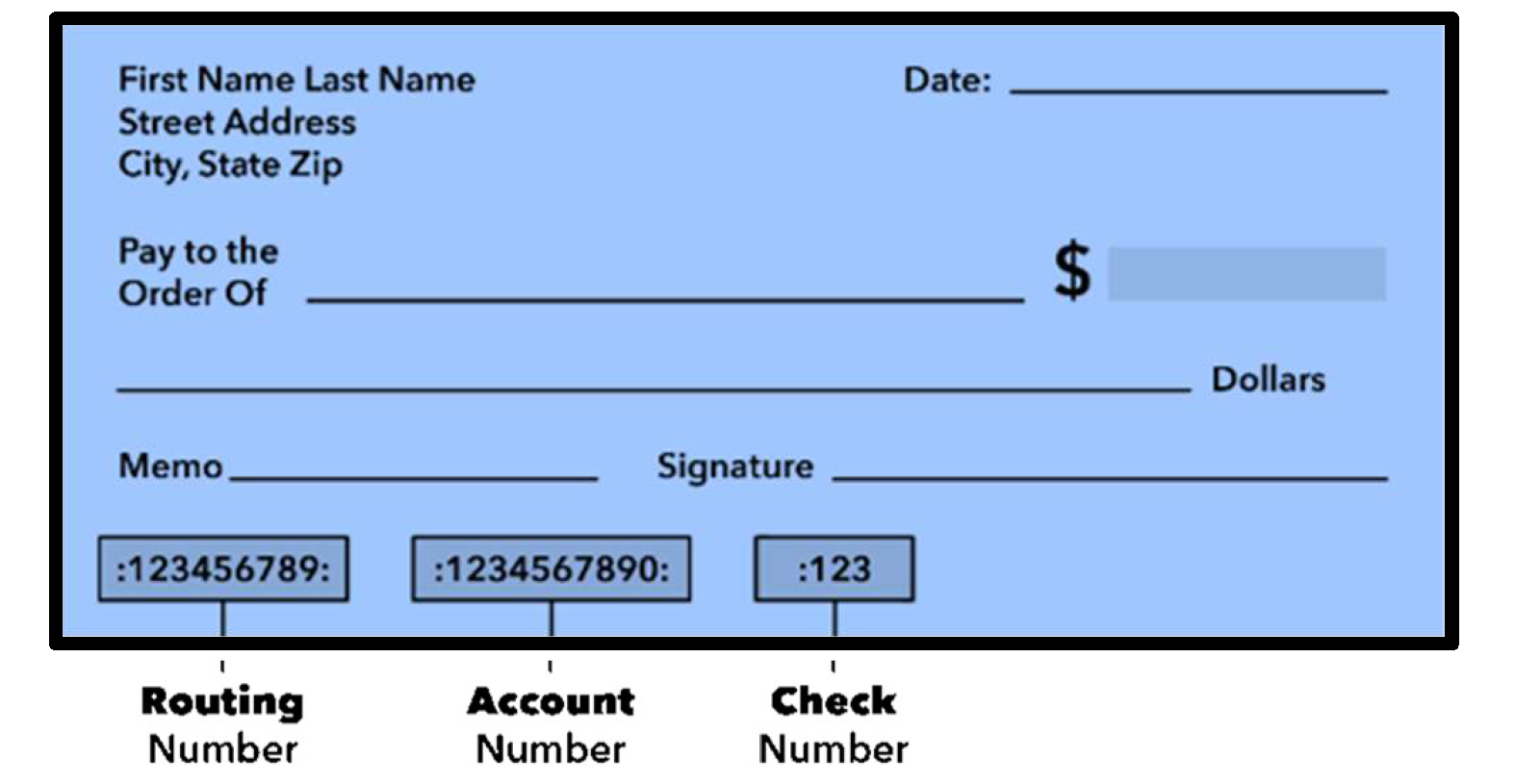

A: Your checking account number is specific to your account. It's the second set of numbers printed on the bottom of your checks, just to the right of the bank routing number. You can also find your account number on your monthly statement, or under the Account Details section in Online Banking or the Mobile Banking app.

How do I pay off a loan with a wire?

A: If you would like to pay off your loan with a wire transfer, please provide your financial institution with the following instructions:

| Institution: | Fidelity Bank, 353 Carondelet St., New Orleans, LA 70130 USA |

| Account #: | 10110300 |

| Routing/ABA #: | 265070532 |

| Account Name: | Loan Payoff Wire Account |

| Instructions: |

ATTN: Payoff Processing

[Your Name]

[Your Fidelity Bank Loan Account Number]

[Your Property Address (if applicable)]

[Your Closing Agent’s Contact Information (if applicable)]

|

Please consult with the sending financial institution regarding fees they may assess for sending wire transfers.

How do I send an outgoing wire transfer?

A: An outgoing domestic or international wire request may be completed in person at any of our financial centers. All wire transfer requests must be received on business days by 5:00 PM (domestic wires) / 3:00 PM (international wires) local time for same-day processing. For businesses, commercial wire services via Online Banking may also be available to you. Please contact your Relationship Manager for additional details.

Generally, you'll need to provide the following information in order to send a wire:

- Personal Identification

- Receiving Bank's Name and Address

- Receiving Bank's Wire Routing/ABA Number

- Receiving Bank Account Number

- Name and Address on the Receiving Account

- If the recipient’s bank has any wire instructions in addition to the above, please provide them to your banker.

Please contact your local Financial Center for additional information, and refer to our Fee Schedule for a complete list of wire transfer fees.

{endAccordion}